Business Insurance in and around Houston

Looking for small business insurance coverage?

Cover all the bases for your small business

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to keep track of. You're in good company. State Farm agent Hien Apple is a business owner, too. Let Hien Apple help you make sure that your business is properly covered. You won't regret it!

Looking for small business insurance coverage?

Cover all the bases for your small business

Protect Your Future With State Farm

Whether you are an electrician a painter, or you own an art store, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Hien Apple can help you discover coverage that's right for you and your business. Your business policy can cover things such as business liability and equipment breakdown.

At State Farm agent Hien Apple's office, it's our business to help insure yours. Visit our terrific team to get started today!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

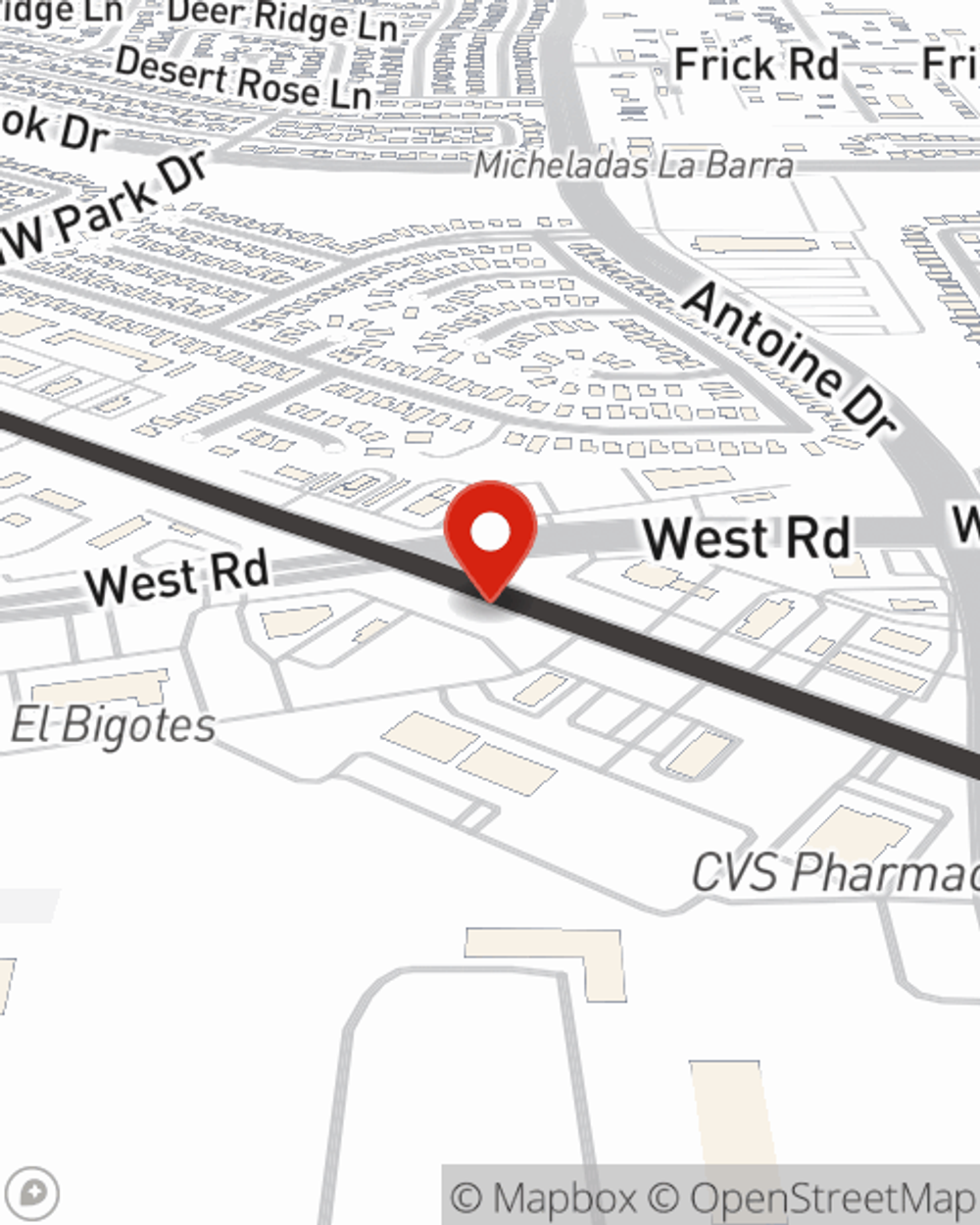

Hien Apple

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.